Real Estate Intelligent

AI Agent

The Real Estate Intelligence Agent turns property data and market signals into accurate valuations and risk-aware decisions — automating due diligence with fast, explainable, and compliance-ready AI workflows.

Turning complex property analysis into controlled, AI-driven workflows

Smart Property Valuation

Instantly analyzes comparable sales, and financial data

Risk & Compliance Analysis

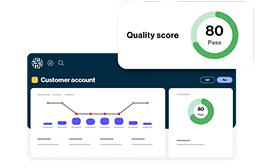

Flags financial, regulatory, and market risks with transparent scoring

Automated Due Diligence

Processes documents, leases, income statements, and reports

Market Intelligence Monitoring

Tracks price movements, demand signals, and neighborhood trends

Explainable Decision Reports

Generates clear AI-backed summaries for lenders, investors

Workflow Automation

Connects data sources into one decision layer for faster approvals and reviews.

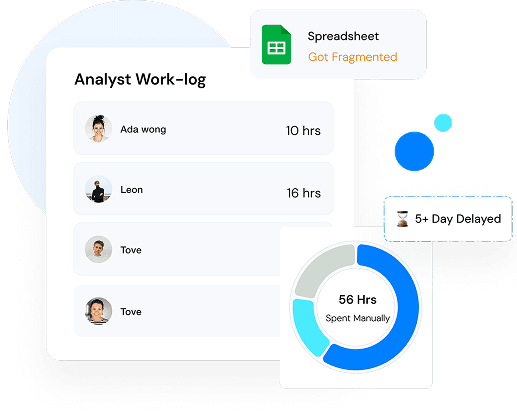

Manual analysis and document heavy workflows delay approvals and increase operational effort.

Manual analysis and document heavy workflows delay approvals and increase operational effort.

Manual analysis and document heavy workflows delay approvals and increase operational effort.

Manual analysis and document heavy workflows delay approvals and increase operational effort.

Turning Fragmented Real Estate Data Into Clear, Risk-Ready Decisions

Your App ✨

Public Announcement...

S1 : Data Ingestion & Unification

Brings property records, financial documents, market data, and external sources into one intelligent decision layer.

S2 : AI Analysis & Risk Scoring

Use Jambo for analyzing and engaging with customer feedback and unlocking valuable insights.

S3 : Decision Outputs & Workflows

Generates valuation reports, risk summaries, and automated approvals — ready for lenders, investors, and teams.

From slower property decisions to faster, risk-ready outcomes

Faster Deal Turnaround

Accelerated Property Evaluations

Cut valuation and underwriting cycles from days to hours by automating data collection, analysis, and report generation — enabling quicker investment and lending decisions.

Higher Accuracy & Confidence

Data-Driven Valuations

Leverage real-time market signals and AI analysis to produce consistent, transparent property valuations with reduced human error and stronger decision confidence.

Lower Risk Exposure

Built-In Compliance & Risk Controls

Identify regulatory issues, financial risks, and market volatility early with explainable scoring — ensuring every decision is traceable and audit-ready.

Scalable Operations

Automated Workflows at Scale

Handle higher deal volumes without increasing headcount by automating due diligence, approvals, and reporting across teams and portfolios.

Residential Projects

Solar solutions for homes

Commercial Projects

Solar systems for businesses

Off-Grid Systems

Independent solar installations

From slower property decisions to faster, risk-ready outcomes

Hannah Parker

Lorem ipsum dolor sit amet, consecter adipiscing elit, sed dolor eiusmod.

Samuel Frost

A Guide to Fantasy Worlds

Lorem ipsum dolor sit amet, consecter adipiscing elit, sed dolor eiusmod.

Ethan Hughes

How to Build a Reading Habit

Lorem ipsum dolor sit amet, consecter adipiscing elit, sed dolor eiusmod.

Grace Sutton

Lorem ipsum dolor sit amet, consecter adipiscing elit, sed dolor eiusmod.

Emma Bennett

Lorem ipsum dolor sit amet, consecter adipiscing elit, sed dolor eiusmod.

Olivia Turner

Top Mystery Novels

Lorem ipsum dolor sit amet, consecter adipiscing elit, sed dolor eiusmod.

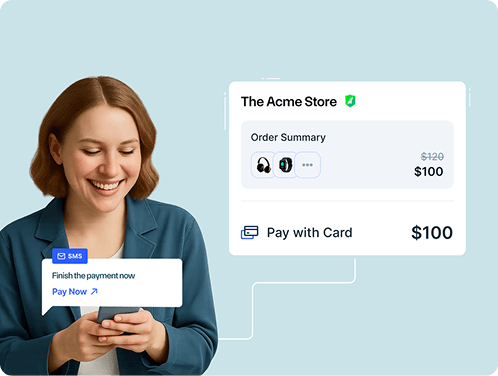

See why financial services organizations

trust 8byte to transform their businesses with unmatched safety and control.

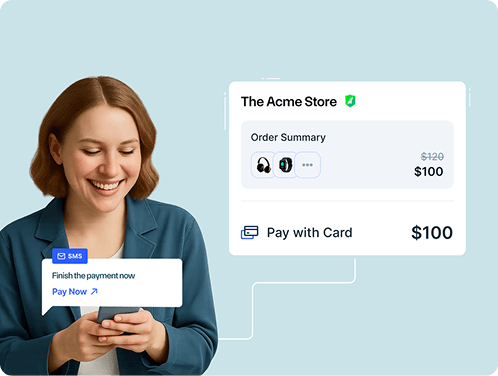

Credit Risk Intelligence Agent

Automates borrower analysis, risk scoring, and compliance checks to accelerate loan approvals with explainable AI-driven insights.

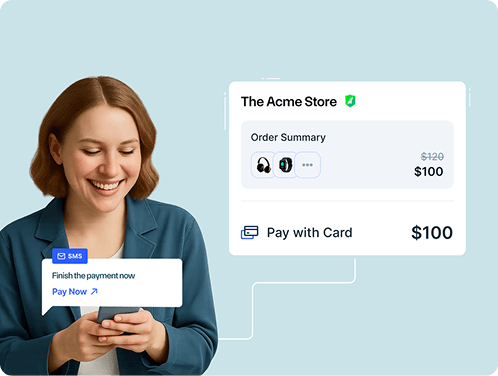

Credit Risk Intelligence Agent

Automates borrower analysis, risk scoring, and compliance checks to accelerate loan approvals with explainable AI-driven insights.

Credit Risk Intelligence Agent

Automates borrower analysis, risk scoring, and compliance checks to accelerate loan approvals with explainable AI-driven insights.