Powering smarter decisions across modern Banking & Lending

Industry Context

Banking and lending teams operate in environments where speed, accuracy, and regulatory compliance must coexist. Yet critical workflows like credit evaluation, risk assessment, and portfolio monitoring remain heavily manual, fragmented across documents, spreadsheets, and legacy systems. As deal volumes grow and regulatory scrutiny increases, institutions need AI-driven decision workflows that are transparent, explainable, and audit-ready by design, not black boxes that create more risk.

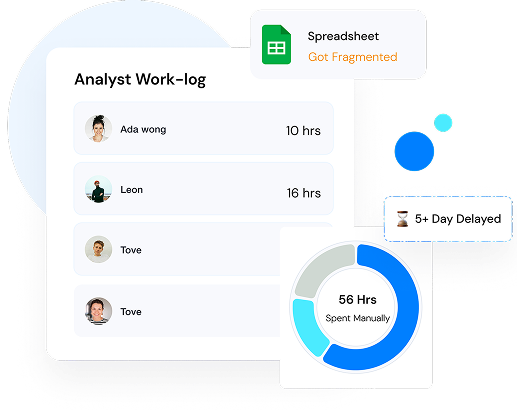

Slow decision turnaround

Manual, document-heavy workflows slow down credit approvals, deal reviews, and risk decisions, increasing analyst effort and cycle times.

Fragmented data sources

Critical data scattered across internal systems, documents, and third-party sources creates reconciliation gaps and increases error risk.

Rising compliance complexity

Evolving regulatory requirements demand explainable decisions, end-to-end traceability, and audit-ready workflows by default.

Inconsistent risk evaluation

Analyst-driven assessments introduce subjectivity, inconsistency, and missed risk signals across portfolios and cases.

Turning complex financial decisions into controlled,

AI-driven workflows

Unified Data Ingestion

Ingest structured and unstructured data from documents, internal systems, and external sources into a single decision layer.

AI Risk Scoring

Generate consistent, explainable risk scores across credit, financial, operational, and compliance dimensions.

Automated Analysis

Automate financial, risk, and document analysis to reduce manual review and accelerate decision cycles.

Human in-the-Loop Decisions

Keep humans in control with configurable review checkpoints, overrides, and approval workflows.

Audit-Ready Logs

Maintain immutable audit logs with full traceability of inputs, decisions, and model outputs.

Seamless Integration

Integrate seamlessly with existing banking systems, data warehouses, and third-party providers without workflow disruption.

AI Decision Support for Banking & Lending

This agent brings together documents, financial data, and internal discussions into a controlled decision workflow. It identifies risks, flags gaps, and generates explainable recommendations aligned to banking and lending use cases, while keeping humans in full control.

Before endorsing, examine the seller contrast chart. A decision is required by the end of the day.

Turning complex financial decisions into controlled, AI-driven workflows

Unified Document Intelligence

Extract and validate data from financial statements, tax returns, and ID documents instantly.

Automated Risk Analytics

Run credit models and compliance checks in real-time without manual spreadsheets.

End-to-End Audit Trail

Track every data point and decision with immutable logs for regulatory readiness.